Loan App Scam: Tracking NCN Credit & CreditWallet

Author: Cybersafe Foundation

Our attention was recently drawn to two loan scam mobile applications on the Google Play Store by a cybersecurity researcher on Twitter, details below:

We immediately decided to investigate in a bid to ascertain what was going on. The first red flag we noticed was in the reviews, some of the users were already making complaints about the request for ATM card details and deductions, see screenshot below:

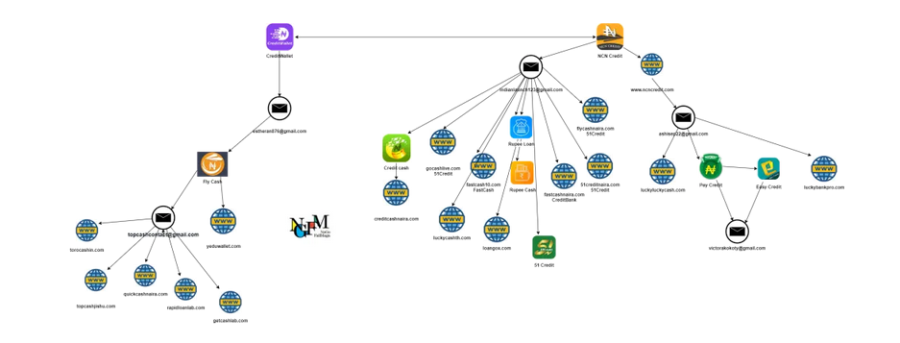

Looking at both apps, we found that the are connected via the same developer “Shawn Xiang,” obviously an alias.

Both apps had different emails listed for the developer and one, NCN Credit, had a website listed. Doing an internet search with the two emails listed, we were able to find a whole lot of other connections. The same people had built various mobile apps and websites to scam those looking for a quick loan, see the link analysis below.

During the analysis of the domains we found, we noticed that most were hosted on the same IP address 159.138.171.212, which belongs to Huawei South Africa Cloud

Below are a list of the 29 domains on the IP Address:

- www.luckybankpro.com

- www.rapidloanlab.com

- www.rupeeloan123.com

- www.fastcashnaira.com

- www.luckyluckycash.com

- www.rupeeloan123.com

- www.creditcashnaira.com

- www.nairacreditone.com

- www.leadingcashcash.com

- www.quickcashnaira.com

- www.urgentcashjishu.com

- www.creditbankkes.com

- www.fastcash10.com

- www.luckyluckycash.com

- www.yeduwallet.com

- www.easycreditngn.com

- www.ncncredit.com

- www.nigeriaucb.com

- www.flycashnaira.com

- www.51creditnaira.com

- www.flycashkes.com

- www.luckycashth.com

- www.quickcashkes.com

- www.creditbankkes.com

- www.speedcash123.com

- www.getcashlab.com

- www.abmoneyclub.com

- www.urgentcashjishu.com

- www.topcashjishu.com

Modus operandi

During the course of the investigation, we discovered two important parts of this scam operation, the use of fake reviews and Facebook targeted ads.

Once an app is deployed on Google Play Store, the scammers post positive reviews, this helps to give the app a nice rating and also attract would-be victims. Below is a sample of positive reviews for one of the fake apps

The other way for them to get victims is through Facebook Ads. Going to the Facebook page of one of the scam mobile apps called Pay Credit, we noticed an ad that has been active since the 24th of March, 2021.

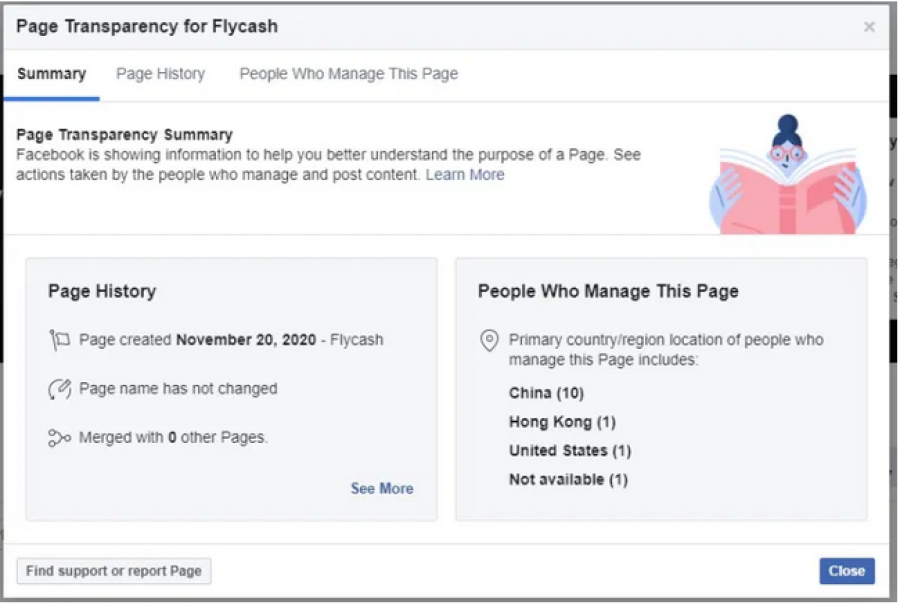

During the course of the investigation, we found another Facebook page for one of their scam application called Fly Cash. It listed thirteen people associated with the page with twelve located in China, one in Hong Kong, one in the United States, and one not available.

This might be an indication of their possible location but cybercriminals have been known to use tools like VPNs to mask their true location especially when doing social media operations.

Why this scam is so effective

Due to the Fintech revolution in Nigeria, individuals now have access to quick loans thanks to various online leading startups. These startups have various Loan apps which have become very popular. These scammers are using the popularity of these loan apps as a pretext to fleece unsuspecting victims. Coupled with the hard economic realities, obtaining credit with ease is very enticing.

Lessons for protection

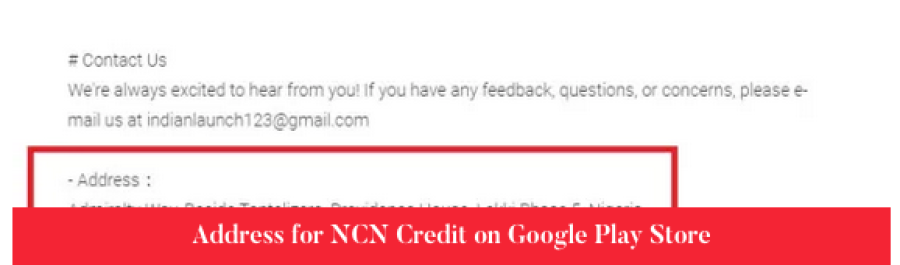

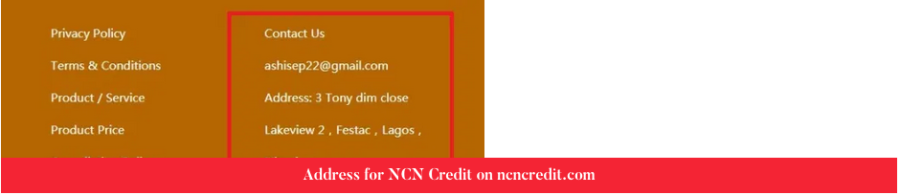

Before installing an app or applying for a loan on your phone, ensure that the company is a legitimate lender. Research the parent company that owns the app. Are they licensed to give out loans? where are they located? One thing we noticed with all the scam loan apps was the use of fake addresses in their contact section.

So, we advise that before you decide to install or use any loan application, check out the contact section and make sure the company is physically present at the address they state.

Don’t blindly trust the reviews you see about the application, make sure you know someone who has used the app and successfully gotten a loan.

Finally, we advise that you normalize the use of virtual prepaid cards to sign up for all online services. This is especially important for services that require a debit/credit card as part of their sign-up process, you can give out a virtual card with a zero balance, and be ready to cancel in the event that something goes wrong.

This article was first published by CyberSafe Foundation on nogofallmaga.org

Report a Scam!

Have you fallen for a hoax, bought a fake product? Report the site and warn others!

Scam Categories

Help & Info

Top Safety Picks

Your Go-To Tools for Online SafetyDisclaimer: Some of the links here are affiliate links. If you click them and make a purchase, we may earn a commission at no extra cost to you.

- ScamAdviser App - iOS : Your personal scam detector, on the go! Check website safety, report scams, and get instant alerts. Available on iOS

- ScamAdviser App - Android : Your personal scam detector, on the go! Check website safety, report scams, and get instant alerts. Available on Android.

- NordVPN : NordVPN keeps your connection private and secure whether you are at home, traveling, or streaming from another country. It protects your data, blocks unwanted ads and trackers, and helps you access your paid subscriptions anywhere. Try it Today!

- Incogni : Incogni automatically removes your personal data from data brokers that trade in personal information online, helping reduce scam and identity theft risks without the hassle of manual opt-outs. Reclaim your privacy now!

Popular Stories

As the influence of the internet rises, so does the prevalence of online scams. There are fraudsters making all kinds of claims to trap victims online - from fake investment opportunities to online stores - and the internet allows them to operate from any part of the world with anonymity. The ability to spot online scams is an important skill to have as the virtual world is increasingly becoming a part of every facet of our lives. The below tips will help you identify the signs which can indicate that a website could be a scam. Common Sense: Too Good To Be True When looking for goods online, a great deal can be very enticing. A Gucci bag or a new iPhone for half the price? Who wouldn’t want to grab such a deal? Scammers know this too and try to take advantage of the fact. If an online deal looks too good to be true, think twice and double-check things. The easiest way to do this is to simply check out the same product at competing websites (that you trust). If the difference in prices is huge, it might be better to double-check the rest of the website. Check Out the Social Media Links Social media is a core part of ecommerce businesses these days and consumers often expect online shops to have a social media presence. Scammers know this and often insert logos of social media sites on their websites. Scratching beneath the surface often reveals this fu

How do I recover my crypto after it’s stolen? What happens if your crypto wallet is compromised? Can stolen crypto be traced, and can police actually recover crypto in 2026? These are the questions most people ask within minutes of realizing their wallet has been drained. Crypto theft is fast, quiet, and unforgiving. By the time most victims notice something is wrong, the funds are already moving across the blockchain. Once seen as a problem for exchanges and whales, crypto theft now heavily affects everyday investors. Phishing links, fake support chats, wallet approval scams, SIM swaps, and malware attacks have become common. Knowing what recovery realistically looks like—and what it doesn’t—can prevent panic, bad decisions, and costly follow-up scams. In a Nutshell Crypto recovery is possible, but only in limited situations Blockchain transactions are irreversible, but stolen crypto can still be traced Speed and documentation matter more than optimism Police and exchanges play a bigger role than private recovery services Guaranteed recovery offers are almost always scams Is it Actually Possible to Recover Stolen Crypto? Yes, crypto recovery is possible, but only under specific conditions and rarely through direct action by the victim. Blockchain transactions are final by design. Once crypto is sent and confirmed, it cannot be reversed. There is no central authority, no chargeback process, and no technical “undo” button, even if the transaction was clearly fraudulent. This is where many people ask whether stolen crypto can be traced. In most cases, it can. Every transaction